Transforming Wealth Management Reporting at Deutsche Bank

Organization:

Role:

Timeline:

Impact:

Deutsche Asset & Wealth Management

UX Lead (Managed 13-person cross-functional team)

December 2014 - August 2016

80% reduction in reporting wait times; 95% legacy bounce rate eliminated

01. The Strategic Challenge

Bridging the Gap in the Aladdin Ecosystem

In 2012, Deutsche Bank (DB) integrated BlackRock’s Aladdin software, a powerful backend solution that lacked a user-facing frontend. Senior stakeholders required a bespoke, “one-stop-shop” platform for Financial Advisors, Family Offices, and Fund Managers to manage portfolios for High-Net-Worth Individuals (HNWI) with assets exceeding $25 Million

The Problem:

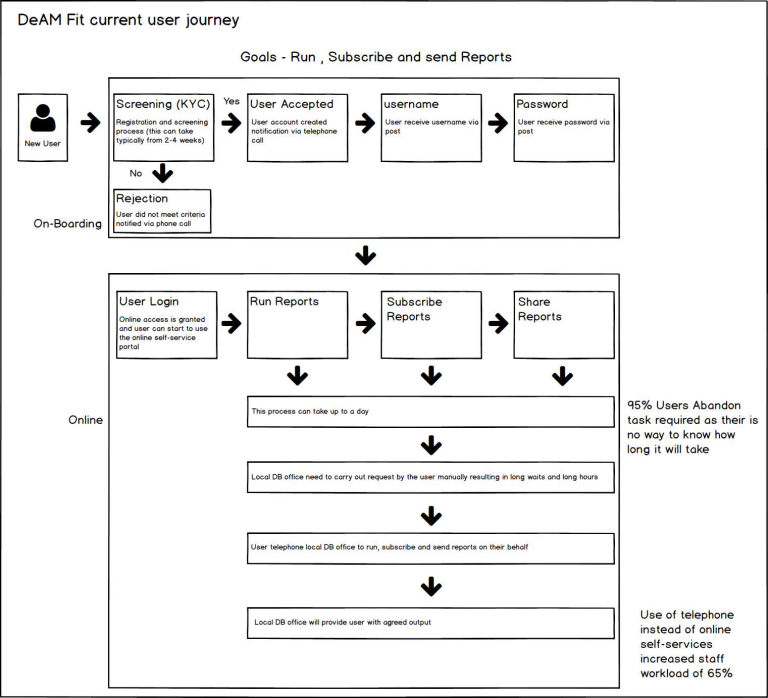

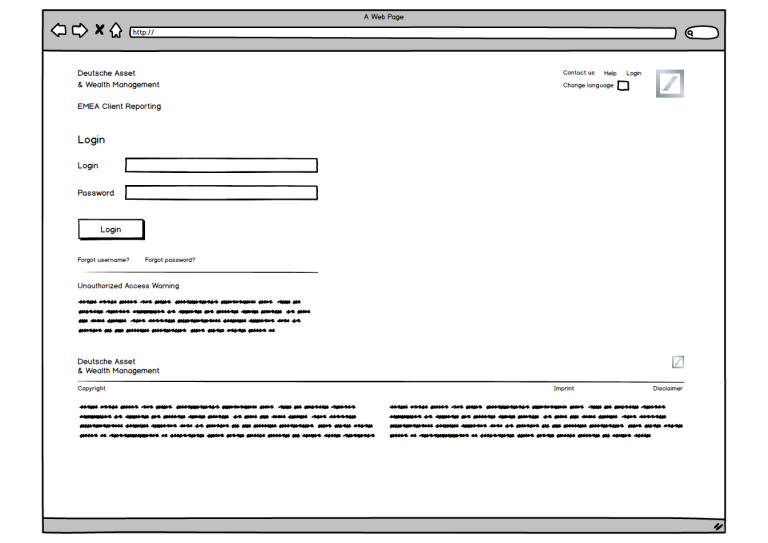

• Legacy Failure: The existing reporting process had a 95% user abandonment rate.

• Operational Inefficiency: Users relied on telephone requests, increasing DB staff workload by 65%.

• Technical Debt: Reports had no progress indicators, leaving users in the dark for hours or days

02. Research & Diplomacy

Understanding the Global Investor

To build a scalable solution, I led a global research initiative encompassing four continents and 12 nationalities.

• Quantitative Effort: Conducted 20 deep-dive interviews with Relationship Managers and Investors.

• Qualitative Discovery: Users revealed that the inability to estimate export times was the primary driver of friction.

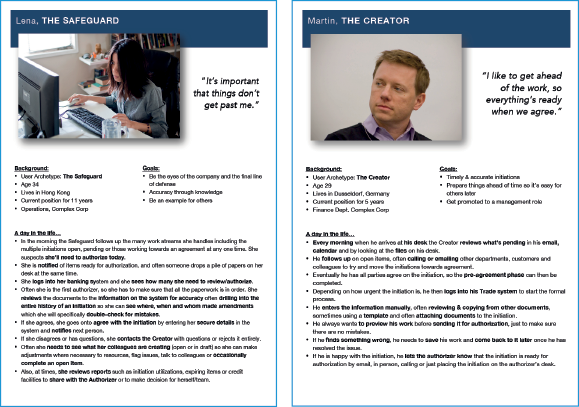

• Persona Development: Created archetypes like “Lena, The Safeguard,” to align the team on accuracy and security needs

03. Strategic Orchestration

Prioritisation through the MVP Lens

As the UX Lead, I managed 2 BAs, 5 Developers, 4 QAs, and 1 PM. We used a Value Matrix to balance competing priorities:

1. User Value: Criticality of the feature to the investor.

2. Business Value: Strategic importance to Deutsche Bank.

3. Tech Value: Ease of development.

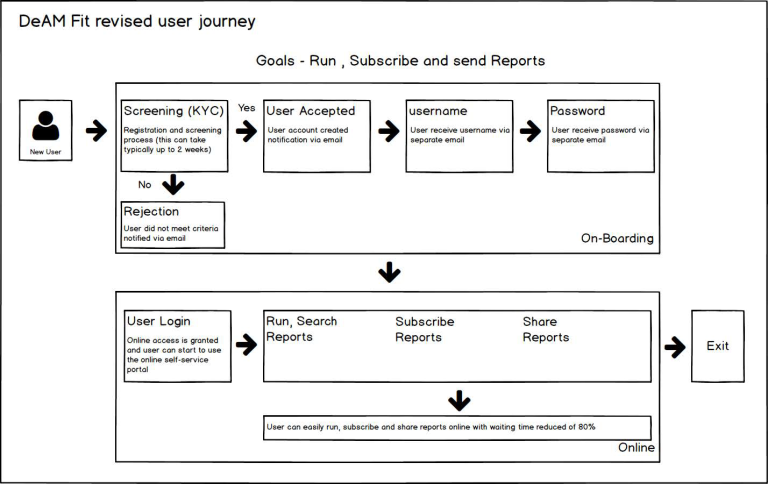

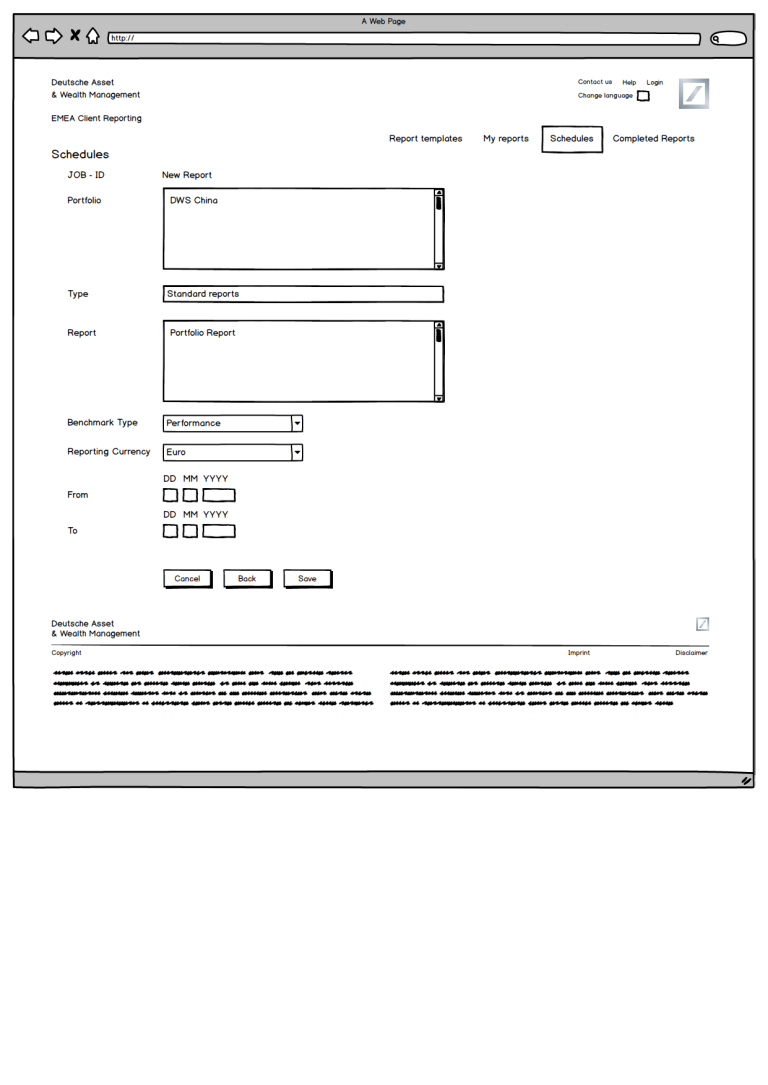

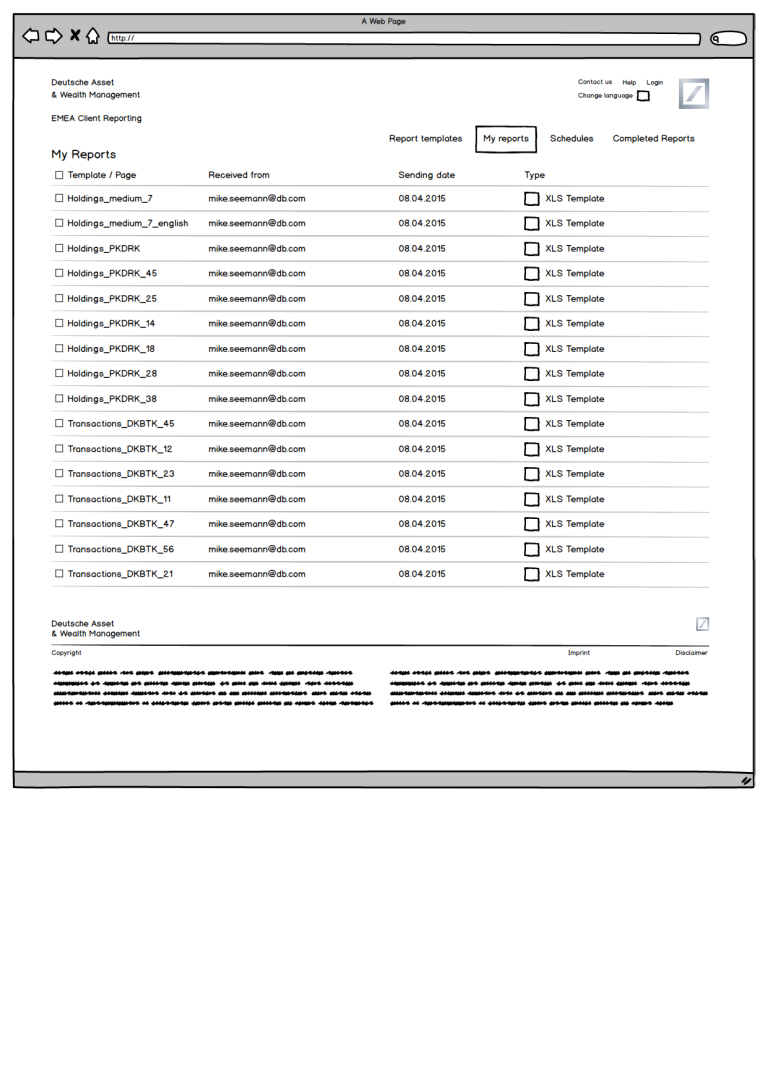

The Solution Architecture: We transitioned from a fragmented, manual journey to a streamlined KYC-integrated online process. I led closed card sorting exercises to ensure the Information Architecture reflected the mental models of fund managers

04. Design & Execution

From Sketches to Technical Specs

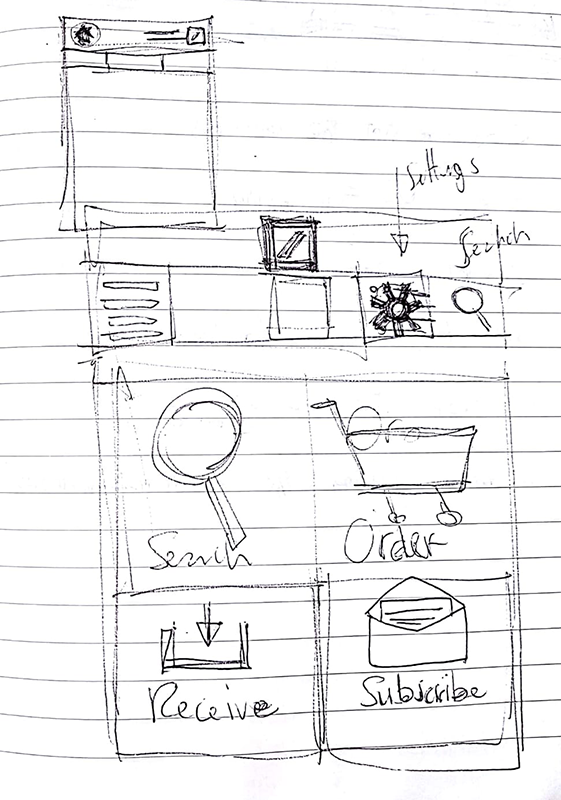

Our process moved through three distinct phases to ensure speed-to-market:

• Phase 1 (MVP): Focused on basic search, order, and receive functionality.

• Phase 2 & 3: Added complex data points, batch exports, and enhanced PDF customisation.

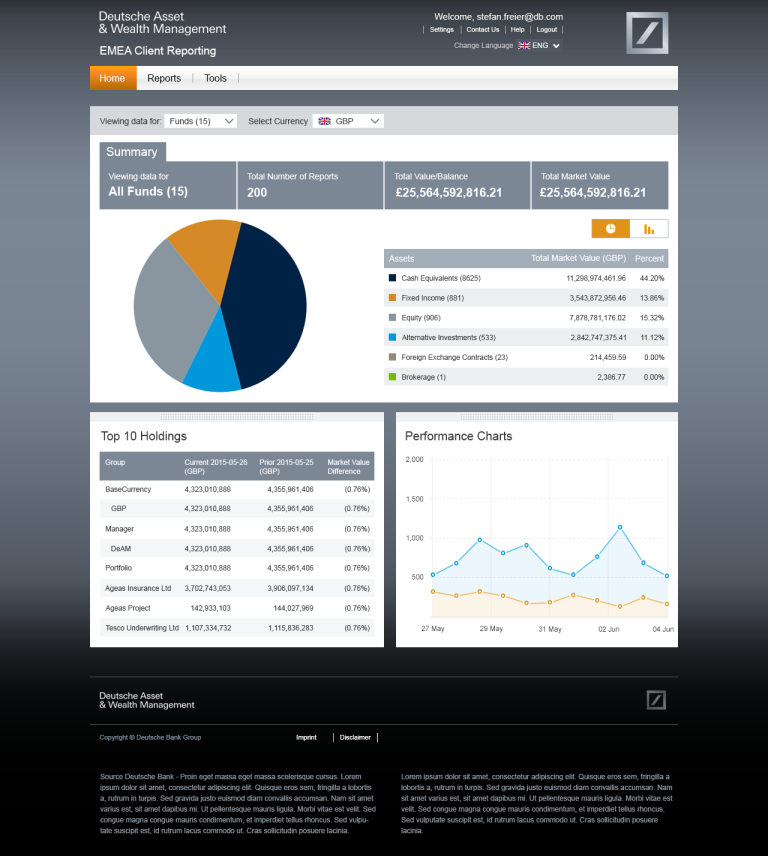

• Technical Hand-off: I specs out high-fidelity Visual Comps for the DEV team, ensuring branding consistency and responsive layout for “Office on the move” usage

05. The Impact

Measurable Success for the Business

The redesign was deemed a success by both stakeholders and the initial interview sample.

• Operational Velocity: Reduced report waiting times by 80%.

• User Adoption: Successfully onboarded 320 active users to the self-service platform.

• Business Growth: The platform now generates 45 monthly new enquiries and 3 new clients per month.

• Internal Relief: Dramatically reduced the 65% staff workload overhead by digitising manual telephone tasks

06. Senior Reflections

Challenges & Leadership

The primary challenge was the initial lack of signposting and difficulty in accessing high-profile end users. I overcame this by building strong cross-functional relationships across the business to secure the necessary user access.

Post-launch, we implemented a weekly data review cycle to monitor uptake and export times, ensuring the platform remains a competitive tool for Deutsche Bank Asset Management